Fair Isaac & Co, or FICO, is a generic term for a credit bureau score and refers specifically to model used by FICO. There are other statistical models, however, FICO is the most widely known.

Credit scoring has become widely accepted by lenders as a reliable means of credit evaluation. The credit score condenses borrowers credit history into a single number. FICO and the credit bureaus don’t reveal the exact methodology for computing the numbers.

FICO scores vary from 375-900 points. The higher, the better. To get the best interest rates, you generally need to score 680 or higher. Someone with higher than 680 is considered to have “A” credit. If you score below 620, you will generally pay a higher interest rate on your mortgage and your credit is considered “sub-prime.” If your score is between 620 and 680, the lender may decide which category you belong based on factors such as income, assets, payment history, etc.

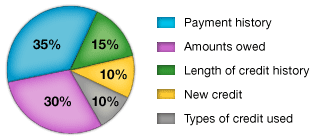

FICO Scores are calculated from a lot of different credit data in your credit report. This data can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

Being financially literate is essential to business success. Being financially literate is more than just knowing what your income statement says or how much cash you have on hand. Business owners often don’t realize that even when they make a profit they can run out of cash. Being financially literate means knowing what information investors want to see, using ratios to assess your financial strengths and take advantage of opportunities and using financial information to make better decisions for the growth of your company.

And that level of financial literacy starts with the basics.

Credit Scoring and FICO

These percentages are based on the importance of the five categories for the general population. For particular groups - for example, people who have not been using credit long - the importance of these categories may be somewhat different.

Payment History

- Account payment information on specific types of accounts (credit cards, retail accounts, installment loans, finance company accounts, mortgage, etc.)

- Presence of adverse public records (bankruptcy, judgments, suits, liens, wage attachments, etc.), collection items, and/or delinquency (past due items)

- Severity of delinquency (how long past due)

- Amount past due on delinquent accounts or collection items

- Time since (recency of) past due items (delinquency), adverse public records (if any), or collection items (if any)

- Number of past due items on file

- Number of accounts paid as agreed

Amounts Owed

- Amount owing on accounts

- Amount owing on specific types of accounts

- Lack of a specific type of balance, in some cases

- Number of accounts with balances

- Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts)

- Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans)

Length of Credit History

- Time since accounts opened

- Time since accounts opened, by specific type of account

- Time since account activity

New Credit

- Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account

- Number of recent credit inquiries

- Time since recent account opening(s), by type of account

- Time since credit inquiry(s)

- Re-establishment of positive credit history following past payment problems

Types of Credit Used

- Number of (presence, prevalence, and recent information on) various types of accounts (credit cards, retail accounts, installment loans, mortgage, consumer finance accounts, etc.)

Visit myfico.com for more information.

Posted at 8:33 AM

Financial Education