Originally posted on the Manufacturing Innovation Blog

Access to capital, especially access by small privately held companies, is a component of growth.

According to an article in Forbes magazine, citing data from Pepperdine University’s 2014 Capital Markets Report, while nearly 89% of business owners report having the enthusiasm to execute growth strategies, only 46% report having the necessary capital resources to successfully execute the growth strategies. Among the smallest businesses (those with less than $5 million in revenue) that sought bank loans in the previous three months, only 39% in the same study reported they were successful in securing a loan. It is also quite common for these small company owners to be turned down for loans and not know exactly the reasons why.

The Reasons Business Loans are Rejected

The President of New Markets and Community affairs at Northside Bank in Adairsville, Georgia, acknowledges that he often hears from business owners whose loan applications have been rejected by other banks and many times they are not told the reason for the denial. His bank is currently working with those clients to help them understand any credit-related shortcomings.

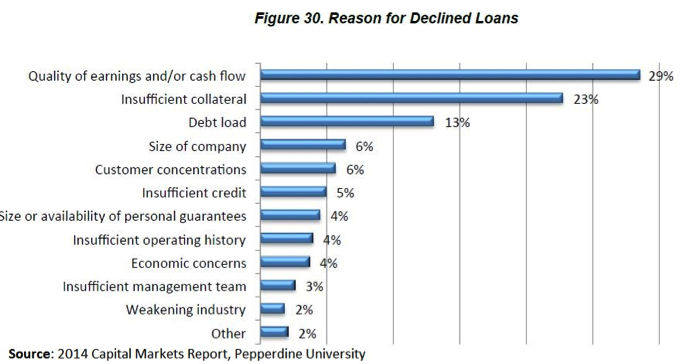

The Pepperdine’s study found the top reason lenders rejected a business loan application was the quality of the applicant’s earnings or cash flow. Quality of cash flow refers to whether cash generated by the company is mostly driven by nonrecurring sources of cash (e.g. sales of assets like real estate, etc.), by something unusual like late payments to vendors, or by profitable and sustainable sales. The challenges to proving good cash flow may be compounded when a company uses accounting practices that maximize expenses to depress cash and earnings and thereby minimize taxes. This strategy typically hurts owners when it’s time to sell the business or apply for a loan, unless they can provide the buyer or lender with additional evidence of the business’ profitability and earning power.

Insufficient collateral and debt load were the next most common reasons cited for loan denials according to the same study. Collateral typically includes, equipment, buildings, inventory or accounts receivables. Debt load includes existing outstanding debt, both long term and short term. Some banks may not require collateral for some borrowers, but overall most do for smaller businesses. The Pepperdine 2014 survey found that banks required collateral 100% of the time for loans of $1 million, and personal guarantees were often required for loans below $5 million. However, most lenders are not really interested in gaining ownership of the collateral, and are more interested in assurances that the loan will be repaid through sufficient cash flow.

The Significance of Cash Flow to Manufacturing Extension Partnership (MEP) centers working with Clients: It has been said that cash flow is the lifeblood of all business. Because it is cash that repays debt (and not necessarily collateral), demonstrating positive cash flow is key for companies.

MEP services that assist companies in achieving significant improvements in the competitive edge elements of process speed, product quality, costs, and business excellence, can help those companies demonstrate to lenders that they are capable of providing high-quality products as efficiently and profitably as possible while being very responsive to customer demand. MEP Centers that include in such services ‘cash to cash’ and ‘call to cash’ discussions with their clients, prepare companies with the insight on what lenders will look for when considering a loan application.

Moreover, company owners considering an ownership transfer at some point in the future will need to think about the value of their company. Since valuations are often based on cash flow or the company’s earning power, improving an understanding on how a company ranks (e.g. are expenses too high compared against sales or compared with competitors) relative to those in the same industry or same geographic area, can be an invaluable instrument to help client companies and business owners.

Applying for a business loan can be frustrating and stressful, and it is confusing to have an application denied with little explanation. But while different banks have requirements and standards when it comes to loan applications, the Pepperdine study reveals that the universal requirement cited is still tied to a company’s cash flow and quality of earnings—i.e. “Cash is King.”

Doug Devereaux is a Senior Industrial Specialist at MEP

Posted at 11:11 AM

Financial Education