|

Created on July 15, 2016 |

Fernando Gracia is an Intern in the Office of the Western Hemisphere at the International Trade Administration

Four years ago, the United States Colombia free trade agreement went into effect, representing a commitment to trade and prosperity between our two countries. Today, we look back at the four years since the United States-Colombia Trade Promotion Agreement (CTPA) entered into force and analyze what it has meant for trade between our two countries.

The overall trend for U.S. exports to Colombia has been positive since the CTPA was implemented in 2012.

-

In 2011, the year before the CTPA came into force, goods exports to Colombia had a value of $14.3 billion. In 2014, goods exports reached a high of $20.1 billion.

-

In 2015, U.S. goods exports to Colombia fell to $16.3 billion, primarily due to the drop in the price of oil and related fuel products. Nevertheless, even with this drop, U.S. goods exports to Colombia have seen a growth rate of 14% ($2.0 billion) over the past four years, compared to 1.4% growth for U.S. exports worldwide.

-

Today, Colombia is the U.S.’s 20th largest goods export partner and the 3rd largest in Latin America behind Mexico and Brazil. Explore U.S.-Colombia trade data here.

The CTPA’s key components that allowed for this growth include the protection and enforcement of intellectual property rights, equal access for services exports, equal access to covered government procurement opportunities, and the elimination of tariffs. When the CTPA took effect in 2012, over 80 percent of U.S. exports of consumer and industrial products to Colombia immediately became duty-free; the remaining tariffs are being phased out over a period of ten years. Recently, on January 1, 2016, more than 500 additional tariff lines became duty free for the first time. This included products like pork products, perfumes, printing ink, soap, paper products, caps and lids, and exercise equipment, among others. (For the latest tariff information on specific goods, check out the FTA Tariff Tool)

At the industry level, various sectors have benefitted from the CTPA. Manufacturing and agricultural exports have experienced major gains:

-

Manufacturing exports grew from $13.2 billion to $14.5 billion, an increase of 9.8%.

-

Agriculture and livestock exports doubled from $648 million to $1.3 billion.

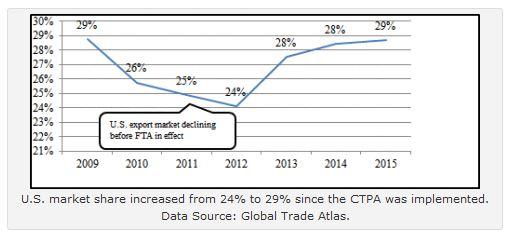

Before the CTPA was implemented, U.S. exporters had seen their share of the Colombian market decline year after year.

-

In 2009, U.S. exports to Colombia made up 29% of Colombian imports, and by 2012 the U.S. share had dropped to a low of 24%.

-

Since the implementation of the CTPA in May 2012, U.S. market share in Colombia has rebounded, reaching 29% in 2015 (Figure 1).

Figure 1: U.S. Exports Market Share in Colombia

At the same time, while the overall value of U.S. goods imports from Colombia decreased by 39% from 2011 to 2015, trade has become increasingly diverse. The falling price of oil is the primary factor behind the diminishing value of U.S. imports from Colombia. The value of mineral fuel imports from Colombia dropped from $16.8 billion in 2011 to $8.1 billion in 2015 (52%), though the quantity of exports remained more steady (oil imports dropped from 160 million barrels to 149 million barrels, or just 7%, during that time). Other sectors performed better:

-

Imports of live plants, especially cut flowers, from Colombia increased from $578 million in 2011 to $624 million in 2015, an increase of 8%.

-

Non-knit apparel imports increased from $117 million in 2011 to $137 million in 2015, an increase of 17%.

-

Aluminum product imports also increased significantly from $41 million in 2011 to $123 million in 2015, an increase of 199%.

In addition, the CTPA increased both the number of companies exporting to the United States and the diversity of the products being shipped.

-

According to ProColombia 2,059 Colombian companies and 104 new products entered the U.S. for the first time since the CTPA took effect in 2012, strengthening and diversifying the trade relationship.

-

97% of these companies are from industry sectors other than mining and energy, two of Colombia’s major export industries. ProColombia put together a list of 10 Colombian companies from diverse industries that have benefitted from the CTPA.

The CTPA’s primary objective and accomplishment has been to provide a platform for both Colombian and U.S. companies to succeed. As the Colombian government approaches a peace agreement with the Revolutionary Armed Forces of Colombia (FARC), we can expect the U.S.-Colombia relationship, including our trade relationship, to only grow stronger.

This is a cross-post from Tradeology ITA's Blog.

Posted at 10:29 AM

Global Opportunities and New Markets

Global Opportunities and New Markets