blog_mechanicalbull_myers.jpg

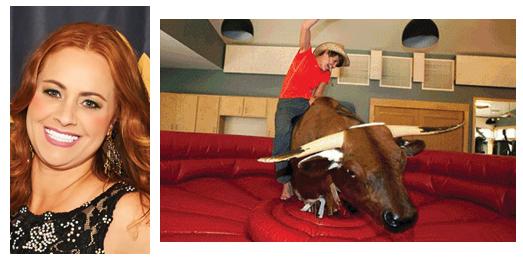

Founded in 2007, Mechanical Bull Sales, Inc. is an innovative woman-owned company that specializes in manufacturing mechanical bull systems.

The entertainment systems are sold throughout the United States and to 44 countries worldwide with just three employees including the company’s president, Gracienne Myers, who runs the business out of State College, Pennsylvania.

“The most important piece of my business is my customer, and for that reason it is my obligation to sell a product that my customer would be happy with and will recommend to others,” said Myers.

When one of her customers in New Zealand was unable to pay upfront, Gracienne researched a way to help them out. In 2015, she discovered the Export-Import Bank of the U.S. (EXIM Bank) and obtained an insurance policy that allowed her to offer her buyer flexible terms for repayment.

“We use EXIM Bank for customers outside of the U.S. that can’t come up with the full amount needed to buy our product; they are usually start-up companies,” explained Myers. “And by offering my customer that financing option, it increased their revenue growth but also allowed them to bring a unique and fun attraction to their customers – a mechanical bull will put a smile on anyone’s face and that is priceless. “

Myers left her home in Brazil at the age of 14 to follow her dreams of becoming an entrepreneur. She got her start at a flower shop in Sao Paulo where she could help the grandmother who raised her. She saved every penny and worked overtime for years until opening her own shop at 19.

In 1997, when the economy of Brazil seemed to be at its worst and had become too dangerous of a place to live, Myers realized it was time for a change and came to the U.S. a year later. In 1998 with the American Dream in her back pocket and $7,000 to her name, the young woman found herself working day and night as a cashier while attending classes at a local college in her spare time to learn English. Through it all, Myers maintained a positive attitude and only focused on results – she continues to approach life with that same attitude today.

“Today, I am an American citizen that is providing jobs with a product sold in 42 states and 44 countries worldwide,” Myers said. “The United States has embraced me and given me the opportunity to grow where Brazil could not, and for that reason and many others I want to give it back by being a productive citizen to this amazing home.”

Since 2009, EXIM has authorized more loans to help grow minority- and women-owned businesses than it did over the previous sixteen years combined - making it the fastest growing sector in the Bank's small business portfolio.

EXIM Bank has a business development team devoted to minority and women-owned businesses (MWOB) which works exclusively with these businesses. They provide hands-on guidance to small businesses and MWOB’s that wish to export and learn how to qualify for and access EXIM financing.

To find out more about EXIM financing and MWOB click here.

ABOUT EXIM BANK:

EXIM is an independent federal agency that supports and maintains U.S. jobs by filling gaps in private export financing at no cost to American taxpayers. The Bank provides a variety of financing mechanisms, including working capital guarantees and export credit insurance, to promote the sale of U.S. goods and services abroad. Almost 90 percent of its transactions directly serve American small businesses.

In fiscal year 2016, EXIM approved $5 billion in total authorizations to support an estimated $8 billion in U.S. export sales. Since 2009, EXIM has supported more than 1.4 million American jobs in communities across the country and sent $3.8 billion of surplus to the U.S. Treasury for deficit reduction.

Posted at 3:02 PM