Small businesses play a critical role in African American communities across the United States—spurring investment, creating jobs, and meeting community needs. Since the beginning of the Obama Administration, the Minority Business Development Agency (MBDA), part of the Department of Commerce, created nearly 11,000 new jobs and saved tens of thousands of existing jobs while helping minority-owned firms obtain nearly $7 billion in contracts and capital. Just last year, minority-owned businesses overall created $1 trillion in economic output and 5.8 million jobs directly - View data from the Minority-Owned Business Growth & Global Reach

Small businesses play a critical role in African American communities across the United States—spurring investment, creating jobs, and meeting community needs. Since the beginning of the Obama Administration, the Minority Business Development Agency (MBDA), part of the Department of Commerce, created nearly 11,000 new jobs and saved tens of thousands of existing jobs while helping minority-owned firms obtain nearly $7 billion in contracts and capital. Just last year, minority-owned businesses overall created $1 trillion in economic output and 5.8 million jobs directly - View data from the Minority-Owned Business Growth & Global Reach

The President has Enacted 17 Tax Cuts for Businesses

The potential of the minority business community has yet to be fully realized. African Americans continue to face challenges gaining access to capital and securing federal contracts. That is why the Administration has put the resources in place to support African Americans starting and sustaining small businesses. Since the beginning of the Administration the President has enacted 17 tax cuts for small businesses, including billions of dollars in tax credits, write-offs, and deductions for Americans who start new businesses, hire the unemployed, and provide health insurance for their employees.

Increasing Access to Capital

Increasing Access to Capital

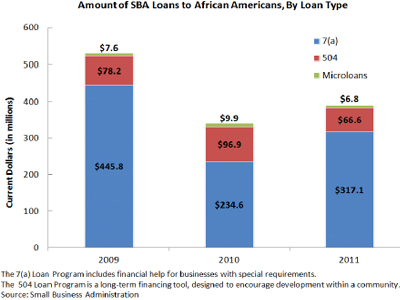

African American entrepreneurs and business-owners continue to struggle to gain access to capital. Regardless of firm size, minority-owned firms are less likely to receive loans than non-minority owned firms - Read the Disparities in Capital Access between Minority and Non-Minority-Owned Business: The Troubling Reality of Capital Limitations Faced by MBEs report. When minority-owned firms do receive financing, it is on average for less money and at a higher interest rate than for those firms owned by non-minorities. To address this challenge, the Obama Administration expanded the Small Business Investment Company program (SBIC). SBIC works by providing capital, long-term loans and management assistance to qualifying small businesses—helping new and growing businesses get their foot in the door. Since Fiscal Year 2009, the program has supported African American-owned businesses with $64 million in financing.

Increasing the number of federal contracts granted to minority- owned businesses is another important way the Administration has worked to level the playing field. Since Fiscal Year 2009, the Administration has awarded $114.3 billion in federal contracts to minority-owned firms.

CDFI awardees have almost tripled jobs

The Community Development Financial Institutions (CDFI) Fund also supports many African American owned businesses. CDFI awardees have almost tripled jobs created since 2007. In fact, from 2007-2009, CDFIs reported almost 14,000 loans to small businesses on average each year, representing an average investment of close to $1 billion annually. CDFI customers are 60 percent minority and more than one fifth of CDFI investment has gone to communities where the African American population is greater than 50 percent. Recognizing the significant role CDFIs play in new business development, the President provided the CDFI Fund with an additional $100 million in funding through the Recovery Act to enhance the lending capacity of CDFIs.

Additionally, the President's budget for 2011 reflected his strong support for the CDFI Fund's role in the recovery, as it proposed allocating $227 million in resources for the CDFI Fund and in 2010, the Administration and Congress supported increased funding for the CDF I Fund to almost $244 million—up from $107 million in 2009.

The New Market Tax Credit also encourages investors to finance organizations in low-income areas. The credit works by providing tax breaks to those CDFIs who invest in organizations which have a certified mission to serve communities in need. The credit totals 39 percent of the original investment amount and is claimed over a period of seven years. Through 2009, almost $4 billion in New Market Tax Credits have been invested in areas where the African American population is greater than 50 percent. To spur even greater investment, the Recovery Act contained an additional $3 billion of New Markets Tax Credit allocation authority.

The Small Loan Advantage and Community Advantage programs

The Administration is committed to supporting the growth of sustainable businesses in African American communities, and every neighborhood looking to prosper. In a key component of the President’s effort on this front, the Small Business Administration launched the Small Loan Advantage and Community Advantage programs—both designed to increase the number of lower dollar loans made to small businesses and entrepreneurs in underserved communities. To date, the Community Advantage program has supported 13 loans worth $1.87 million, specifically targeting community-based financial institutions focused on this mission. Research shows that loans in small dollar amounts have an immense impact on small business formation and growth, providing entrepreneurs with the financing they need to get their foot in the door.

Read The White House recently released report entitled, “The President’s Agenda and the African-American Community.” The report highlights how the Obama Administration has reformed investments to reward work, improve education and increase college access and affordability, keep Americans in their homes, increase access to health care, and invest in small businesses have made a significant impact in African American Communities.